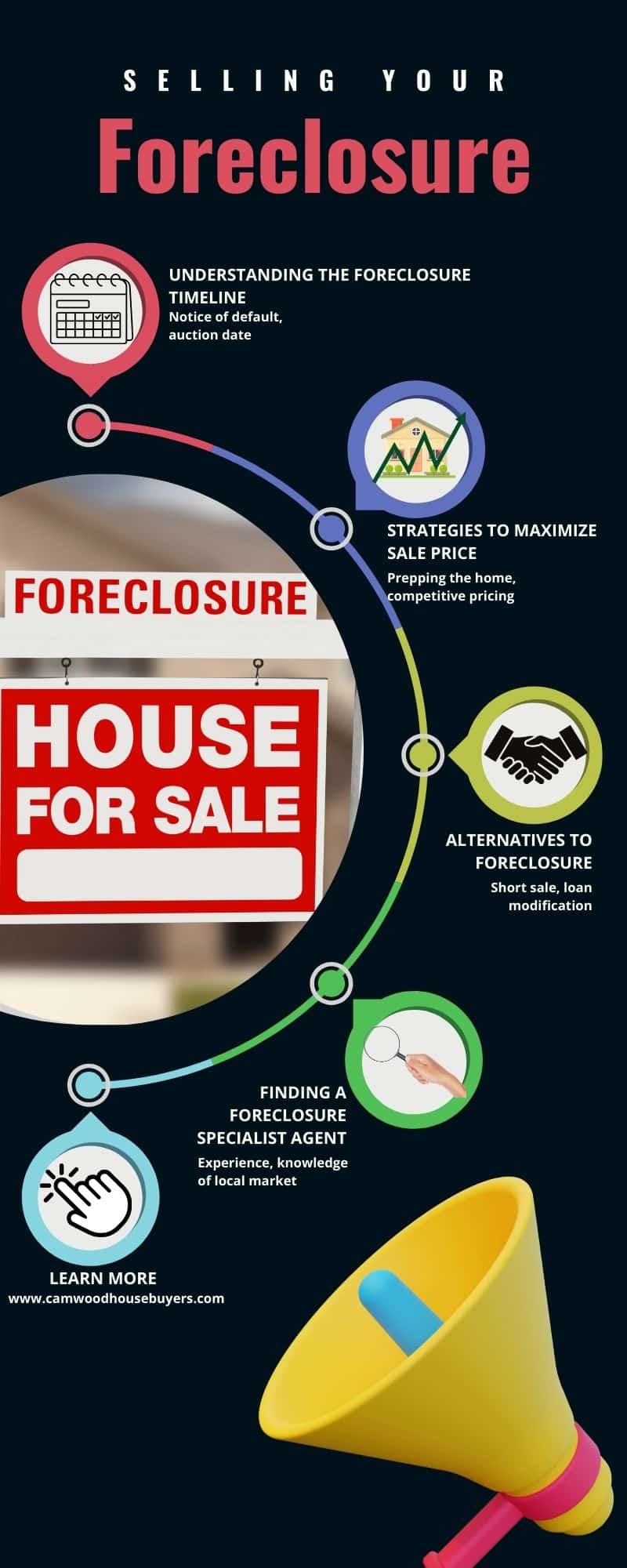

• Definition: A short sale allows you to sell your property for less than the amount owed on your mortgage, with the lender’s approval. The lender agrees to accept a loss to recoup some of their investment

• Process: You work with a real estate agent to list and sell the property at a fair market value. The proceeds are used to pay off the lender as much as possible, and the remaining debt might be forgiven (depending on negotiation and lender policies).

• Benefits: Avoids the lengthy and damaging foreclosure process. Protects your credit score from the severe impact of foreclosure. Allows you to potentially walk away with some cash after the sale.

• Definition: Foreclosure is a legal process where the lender repossesses your property to sell it and recover the remaining mortgage balance.

• Process: The lender initiates legal proceedings, leading to a public auction where the property is sold. You are forced to leave the property and may be responsible for any deficiency balance (remaining debt after the sale).

• Drawbacks: Takes a significant toll on your credit score for up to seven years, making it difficult to secure loans in the future. Eviction from the property can be stressful and disruptive.

• Severity of Default: If you’re only slightly behind on payments, a short sale might be a viable option. For significant defaults, foreclosure might be inevitable.

• Market Conditions: In a seller’s market, selling quickly through a short sale might be easier. In a buyer’s market, a foreclosure might take longer to resolve.

• Your Financial Situation: Consider your ability to afford the remaining debt after a short sale and your future financial goals.

Seeking Help:

• Mortgage Lenders: Most lenders have programs to help struggling homeowners. Contact them to discuss loan modification options or a potential short sale.

• Housing Counseling Agencies: Non-profit agencies can provide free foreclosure prevention counseling and guide you through the process.

Short sale and foreclosure are both difficult decisions, but understanding the pros and cons allows you to make an informed choice. Reach out to your lender and explore all options before falling behind on payments. With proactive measures, you might be able to navigate this challenging situation and potentially save your home.